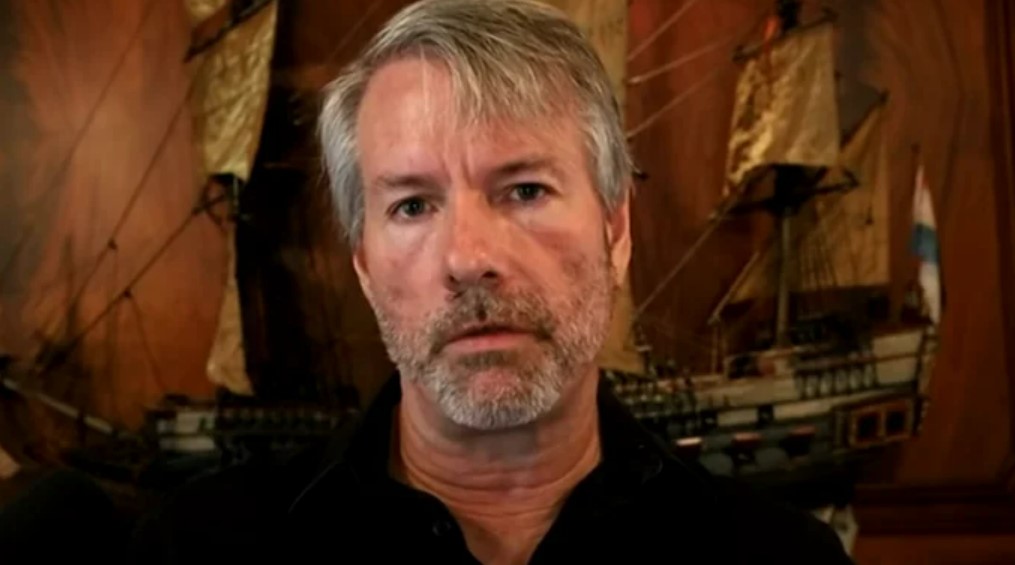

Heralding a possible era of dominance for Bitcoin, Michael Saylor, co-founder of MicroStrategy, boldly suggests that U.S. regulatory actions may soon propel Bitcoin's price beyond the remarkable $250,000 mark. He argues that the Securities and Exchange Commission's (SEC) stringent rules against cryptocurrency firms could inadvertently favor Bitcoin, as it is the only crypto champion exempt from being classified as a security.

In a recent conversation with Bloomberg on June 13, Saylor elaborated on the outlook of U.S. regulators, expressing that they lack a "legitimate path forward" for cryptocurrencies. He further contended that these regulators show no favoritism towards stablecoins, crypto-tokens, or crypto-based derivatives.

The marked increase in Bitcoin's market share, from 40% to 48% in 2023, is a telling sign of this trend. Saylor cites the SEC's rigorous enforcement activities and the classification of 68 cryptocurrencies as securities as potential factors fueling this rise. Interestingly, none of these securities are proof-of-work, unlike Bitcoin.

Anticipating the future, Saylor projects Bitcoin's market dominance to surge to 80%. He explains that once the current "confusion and anxiety" surrounding the crypto market dissipates, "mega institutional money" will find its way into crypto.

Despite his bullish predictions, Saylor and fellow Bitcoin proponents haven't escaped criticism. Anthony Sassano, host of The Daily Gwei, sharply condemned the self-professed "Bitcoiners" who appear delighted at the SEC's lawsuits against Coinbase and other crypto exchanges, branding tokens listed by them as unregistered securities.

Moreover, proponents of a diversified blockchain future, such as the team behind the Ethereum-based wallet MetaMask and others, believe that different blockchains cater to distinct purposes. Similarly, in January, economist Lyn Alden forecasted significant turbulence for Bitcoin in the latter half of 2023, suggesting that resolving the U.S. debt issue would significantly withdraw liquidity from the markets. Amidst varying viewpoints, Saylor stands firm in his conviction that Bitcoin's day in the sun may be fast approaching.

Comment 0