FTX has suffered a significant loss as it sells off LedgerX in a court-approved transaction. The bankruptcy proceedings have resulted in M7 Holdings acquiring the derivatives trading platform for $50 million.

The deal was made as a result of FTX's Chapter 11 bankruptcy filing in November 2022, which saw FTX.US acquire LedgerX for nearly $300 million in August 2021. Former CEO Sam Bankman-Fried emphasized the acquisition's importance for FTX's operations in offering derivatives to American customers. US Bankruptcy Court Judge John Dorsey granted approval for the M7 Holdings acquisition with no objections raised. The CFTC regulated LedgerX, which remained stable despite the company's dramatic downfall.

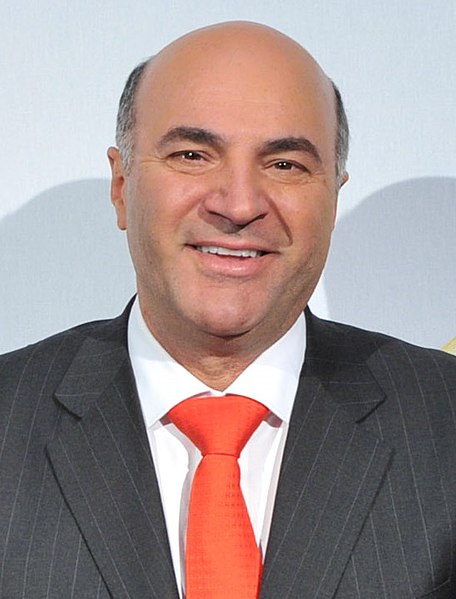

FTX's business model aimed to enable users to buy, sell, and speculate on digital assets' future value. Bankman-Fried, once a prominent figure in San Francisco's advertisements, is facing 13 criminal charges and has been indicted for wire fraud and conspiracy to commit money laundering.

The sale of LedgerX will serve as restitution for former clients who suffered losses in FTX's collapse. The acquisition is projected to compensate for the company's uncertainties, including criminal investigations and legal disputes.

LedgerX CEO Zach Dexter expressed satisfaction with the US Bankruptcy Court in Delaware's verdict. The acquisition is expected to lead to significant changes in LedgerX's operations, including developing new products and expanding its customer base.

The acquisition marks another unfortunate turn of events for FTX.US. However, the new acquisition will revive LedgerX and offer a fresh start to its customers. It will take a long while for all companies affected by the FTX fallout to shed off their involvement with the now-bankrupt crypto exchange firm.

Comment 0