Crypto exchange Binance released a guide to help users earn crypto with Binance Lending.

Crypto HODLer or traders can earn passive income through lending. The good thing with lending is that it offers gains regardless of how the market is performing.

Binance Lending allows its users to increase their wealth by accruing interest on their funds. When users lend their assets to margin traders on the platform, they will be paid interest in return for borrowing their funds. The platform offers a wide variety of cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Binance USD (BUSD), Tether (USDT), and more.

Binance Lending offers two types of lending projects Fixed Deposits and Flexible Deposits. The former locks the funds for a predetermined amount of time and interest. The second one allows users to withdraw funds any time and the interest rates change over time. Since users have the flexibility to withdraw their funds, the interest rates for Flexible Deposits are lower.

Fixed Deposits

Fixed Deposit lending is better suited for long-term investors who are committed to holding their crypto. With this approach, one can easily earn interests. However, when one subscribes his crypto to this type of lending it will not be accessible for a certain duration.

If one has subscribed to this type of lending and badly needs to access his funds, a portion of it can be transferred to Flexible Deposits. The lending period is either 14 or 30 days.

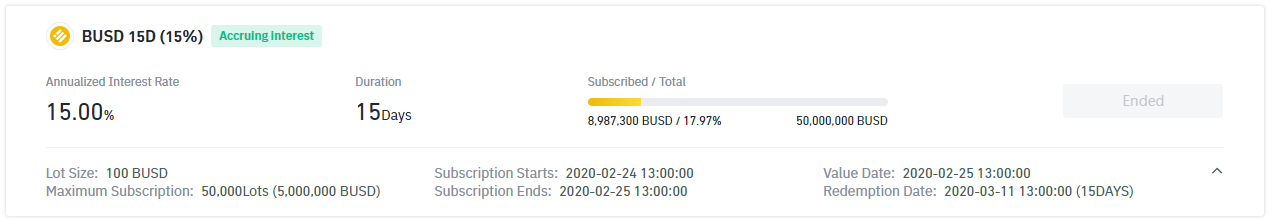

Here’s the information for Fixed Deposits.

Flexible Deposits

Flexible Deposits are like crypto savings account. One can subscribe his fund to earn interest and redeem it anytime. However, the interest rates is smaller compared to Fixed Deposits because of the flexibility it offers.

When one subscribes his funds to a Flexible Deposit, they will be locked for that day, which means it won’t accrue interest and won’t be available for withdrawal until the following day.

To redeem it, one can choose standard or fast redemption. The latter will make the funds available instantly, but the user won’t enjoy that day’s interest paid out. For standard redemption, the funds will be unlocked the following day and the user will enjoy the interest from the day the redemption is initiated.

“The interest for Flexible Deposit products is distributed daily. Please note that Flexible Deposit products are closed for subscription from 23:50-00:10 UTC. The subscription quotas are also reset during this time. As such, if the daily quota for a lending product is full, your best bet is trying to get in early on the next day,” Binance wrote.

Meanwhile, Binance announced recently that it just doubled the fees for Ether (ETH) withdrawals. Crypto traders were not happy with the changes.

Comment 9