Prenetics Global Limited, a health sciences company linked to global football icon David Beckham, has announced it will stop acquiring Bitcoin in 2026, signaling a notable retreat from the corporate Bitcoin treasury strategy that gained momentum earlier in the market cycle. The company confirmed that it ended its daily Bitcoin purchases in December 2025 and has no plans to resume further acquisitions, although it will continue to hold its existing Bitcoin reserves.

This decision comes amid a broader reassessment by public companies following Bitcoin’s sharp drawdown in late 2025. The cryptocurrency’s decline in November and December placed significant pressure on firms that used their balance sheets to gain exposure to digital assets. That stress was most clearly reflected in MicroStrategy, whose stock price dropped far more aggressively than Bitcoin itself during the downturn. Over the past six months, MicroStrategy shares have fallen by more than 60%, underscoring how equity-funded Bitcoin strategies can amplify losses through leverage, dilution, and shifting investor sentiment.

The divergence between Bitcoin’s price action and the performance of companies holding large crypto treasuries has raised concerns among investors and corporate boards alike. For non-crypto firms, becoming a high-beta proxy for Bitcoin introduces governance, reputational, and capital allocation risks. Shareholders often prefer predictable use of cash over exposure to a volatile and cyclical asset, particularly during periods of market uncertainty.

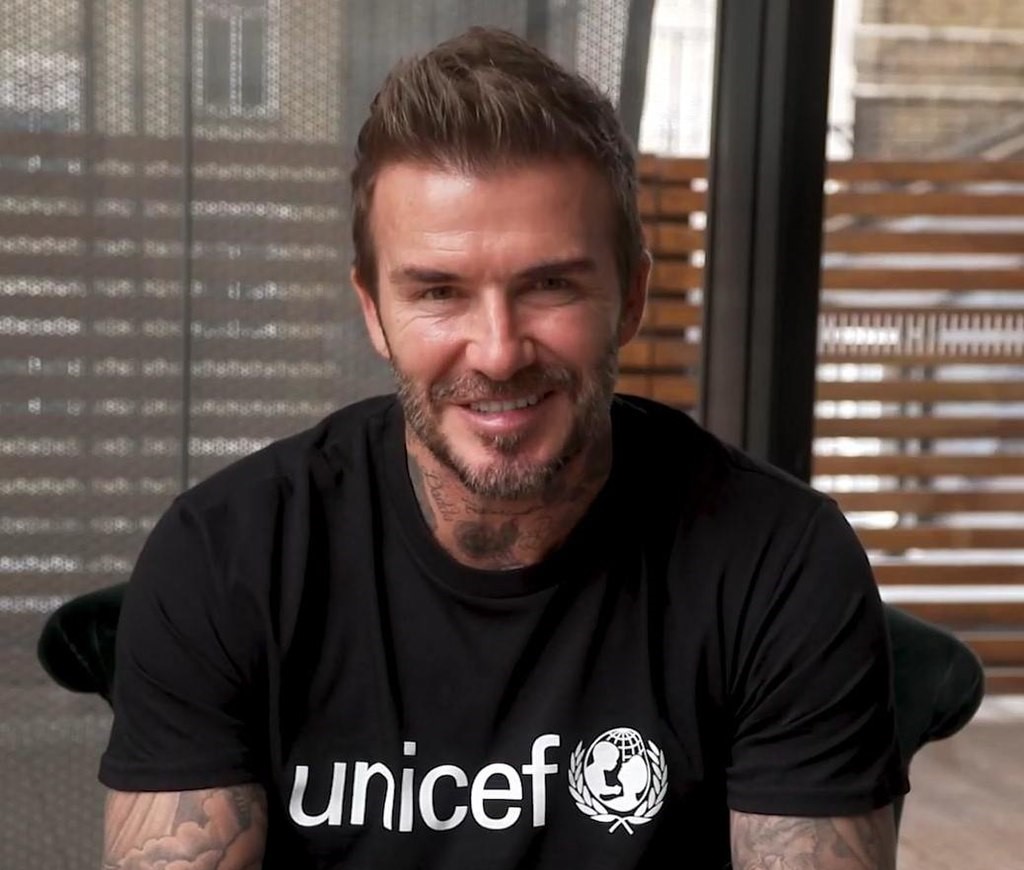

Against this backdrop, Prenetics’ move appears less like a rejection of Bitcoin and more like a risk management decision. The company’s ties to David Beckham extend through IM8, a premium health and longevity brand co-founded with the former football star. IM8’s strong revenue growth and expanding operating opportunities have shifted Prenetics’ strategic focus toward business expansion rather than financial engineering via crypto assets.

By halting future Bitcoin purchases while retaining its current holdings, Prenetics reduces its exposure to crypto market volatility while preserving potential upside. The decision reflects a wider cooling of corporate enthusiasm for Bitcoin treasuries, highlighting how late-2025 market stress has prompted public companies to rethink the balance between innovation, risk, and shareholder expectations.

Comment 0