Bitwise Index Services, a subsidiary of Bitwise Asset Management, has launched three additional indexes covering the mid-cap, small-cap, and total-market segments of the cryptoasset market.

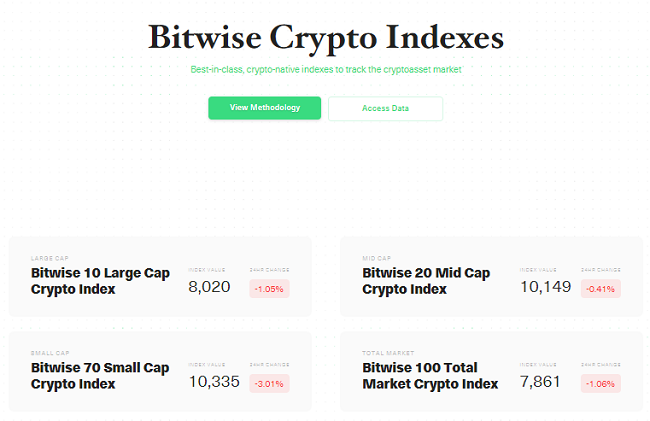

In conjunction with the launch, Bitwise has also announced it was renaming the Bitwise HOLD 10 Index to the Bitwise 10 Large Cap Crypto Index. With this, the Bitwise Crypto Index family now features:

- Bitwise 10 Large Cap Crypto Index (ticker: BITX)

- Bitwise 20 Mid Cap Crypto Index (ticker: BITW20)

- Bitwise 70 Small Cap Crypto Index (ticker: BITW70)

- Bitwise 100 Total Market Crypto Index (ticker: BITW100)

The launch comes on the heels of the filing of the registration of the cryptocurrency index exchange-traded fund (ETF) by Bitwise Asset Management last month. The ETF aims to track the returns of the now renamed Bitwise HOLD 10 Index, a market-cap-weighted index of the 10 largest cryptocurrencies, rebalanced monthly.

To support the indexes, Bitwise also announced the launch of an index advisory board, featuring experts in institutional indexing and cryptoeconomics including Srikant Dash, former Global Head of Indexing for Bloomberg and the former Managing Director and Global Head of Research at Standard & Poor's Indices; Spencer Bogart, Partner and Head of Research at Blockchain Capital, a leading venture capital firm focused exclusively on the blockchain technology sector and crypto ecosystem; and Matt Hougan, Global Head of Research at Bitwise and former CEO of both ETF.com and Inside ETFs.

According to the official release, the Bitwise Crypto Indexes are broadly available throughout the financial ecosystem, including via Bloomberg, Reuters, FactSet, and other data aggregators, as well as the Bitwise website and API.

Bitwise also announced the creation of API access and complimentary benchmarking for hedge funds, researchers, or others interested in high-quality crypto index data.

"Our indexes are built from the ground up to respond specifically to the cryptomarket," said Hougan. "The methodology draws on best practices from the modern indexing of equities, bonds, commodities, and fiat currencies, and pairs them with crypto-native factors to ensure the indexes are safe and replicable. We believe they are the best representation of the investable cryptoasset market in the world."

Comment 16