Analysis Reveals Concentration of TRUMP and MELANIA Tokens Among Few Addresses

Blockchain analytics firm Chainalysis reports that while most wallets holding the TRUMP meme coin belong to individual investors barely breaking even, approximately 50 large holders, or "whales," have realized profits exceeding $10 million. Additionally, although the majority of addresses hold less than $100 worth of TRUMP or MELANIA tokens, some possess holdings exceeding $100 million. Notably, over 80% of addresses with less than $1,000 in assets on the Solana (SOL) network include TRUMP or MELANIA tokens, indicating a surge of new individual investors. Approximately 40 addresses hold more than $10 million worth of these tokens, collectively accounting for about 94% of the total supply.

Real-World Asset (RWA) Ecosystem's Total Value Locked (TVL) Reaches $7.3 Billion, a 200% Year-over-Year Increase

The Block reports that the total value locked in the cryptocurrency ecosystem related to real-world assets has grown by 200% over the past year, reaching $7.3 billion. Leading projects include USD0 by USUAL and Hashnote's tokenized money market fund USYC, each with approximately $1.48 billion in TVL. Notably, about two-thirds of the TVL in the RWA-related crypto ecosystem consists of government bonds. This trend reflects increasing trust in government-backed digital assets and a maturation of the market as protocols focus on traditional financial products.

Michael Saylor Advocates for Bitcoin as a Strategic Reserve Asset for All U.S. States

Michael Saylor, founder of MicroStrategy, the company holding the most Bitcoin among publicly traded firms, stated on X (formerly Twitter) that all U.S. states should adopt Bitcoin as a strategic reserve asset. Currently, 12 U.S. states are reportedly pursuing legislation to designate Bitcoin as a strategic reserve asset.

100% Downside-Protected Bitcoin ETF Officially Launches Today

Bloomberg analyst James Seyffart announced on X that U.S. asset management firm Calamos Investments is launching a 100% downside-protected Bitcoin ETF (ticker: CBOJ) today. The official upside cap for returns until January 31 of next year is 11.65%. While such structured products offer downside protection, they limit potential upside gains. CBOJ's Bitcoin upside cap will reset annually, providing investors with protection against negative Bitcoin returns over the subsequent 12 months.

Bitwise Registers DOGE ETF in Delaware

According to Tree News, U.S. asset management firm Bitwise has completed the registration of a Dogecoin (DOGE) ETF entity in Delaware. Bloomberg analyst James Seyffart clarified that this is merely a trust registration and not an official ETF filing. His colleague, Eric Balchunas, confirmed the legitimacy of the registration, distinguishing it from unfounded rumors such as those regarding a BlackRock XRP ETF.

Lido Co-Founder Clarifies No Second Ethereum Foundation Established

Konstantin Lomashuk, co-founder of Ethereum staking platform Lido (LDO), stated on X that a second Ethereum Foundation has not been established, countering previous reports. He emphasized that if a second foundation were to be created, it should have a clear purpose to complement the substantial work of current Ethereum contributors.

Solana DEX Trading Volume Surpasses Ethereum by 268% in January

The Block reports that in January, the trading volume on Solana's decentralized exchanges (DEXs) was 268% higher than that on Ethereum's DEXs, a significant increase from 53% during the same period last year. Solana processed $122 billion in trading volume, while Ethereum handled $45 billion. Raydium led the Solana ecosystem with a weekly trading volume of $32 billion, compared to Uniswap's $20 billion on Ethereum during the same period.

Rumors of Ledger Co-Founder’s Kidnapping Unsubstantiated

BeInCrypto reports that rumors circulating about the kidnapping of Eric Larchevêque, co-founder of hardware wallet manufacturer Ledger, appear to be unfounded. Local media had claimed that Larchevêque was abducted and that the kidnappers demanded a ransom in Bitcoin. However, these reports seem to be fabricated, and Larchevêque's current whereabouts are unknown.

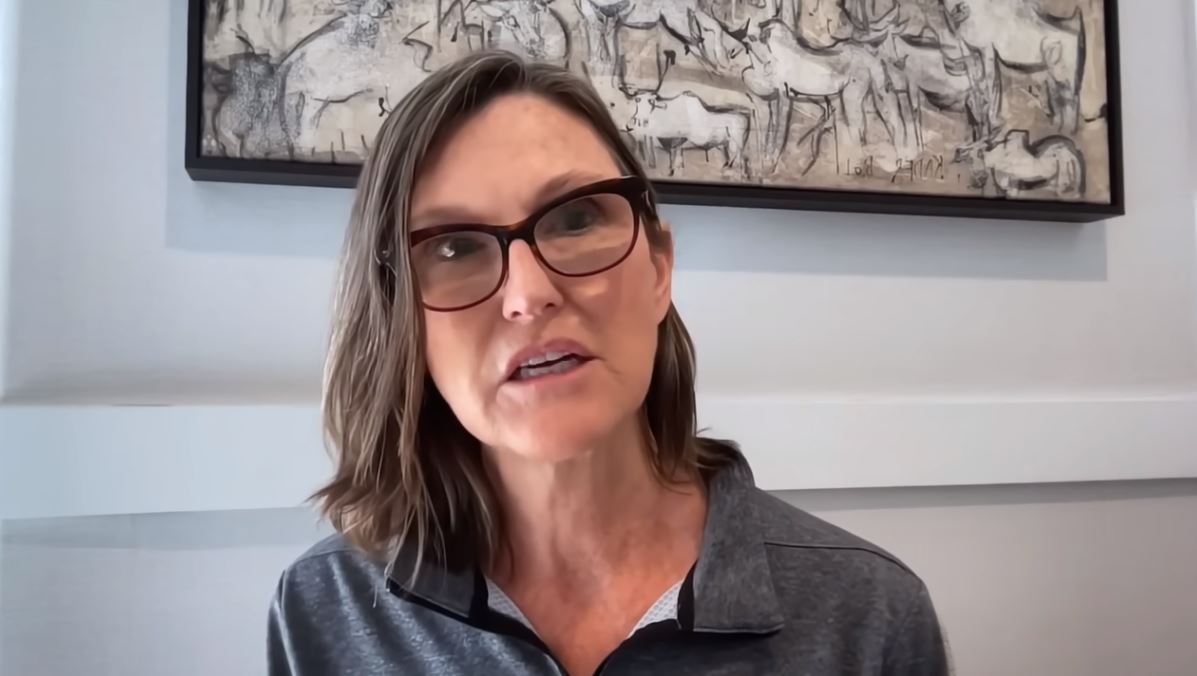

Cathie Wood Comments on TRUMP Meme Coin

Cathie Wood, CEO of ARK Investment and issuer of a Bitcoin spot ETF, stated in an interview with Bloomberg that while the TRUMP meme coin is interesting, she does not intend to invest in it. She clarified that she holds only the "big three" tokens: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). Wood added that although she doesn't view the TRUMP coin negatively, it might become useful in the future.

Industry Criticism Following TRUMP Meme Coin Launch

CoinDesk reports that industry experts have criticized the launch of President Donald Trump's TRUMP meme coin. While meme coins are a notable use case of blockchain technology, they can be perceived by some developers as a quick path to wealth, potentially undermining the credibility of the cryptocurrency industry. Additionally, the launch raises concerns about conflicts of interest among meme coin stakeholders. Anthony Scaramucci, founder of hedge fund SkyBridge Capital, highlighted that the primary issue is that anyone worldwide can now transfer money to the U.S. President's account with just a few clicks.

California Court Dismisses Appeal Between Curve Founder and Three Venture Capital Firms

DL News reports that the California Court of Appeal has dismissed an appeal against Curve (CRV) founder Mikhail Egorov. The court ruled that California is not the appropriate jurisdiction for the case. The lawsuit was filed by venture capital firms ParaFi, Framework Ventures, and 1kx, who participated in a funding round for Curve's parent company, Swiss Stake GmbH. They alleged that Egorov locked up more CRV than initially planned and used their investment to earn fee income, without providing the promised equity in Swiss Stake or returning their $1 million investment. In September 2023, the court dismissed the case, noting that Egorov had not resided in California since 2018.

Comment 0