A majority of participants on Pump.fun, a decentralized platform focused on Solana-based memecoins, have not achieved profits exceeding $10,000, recent analytics reveal. Despite the platform’s popularity, few traders have managed to capitalize significantly on its offerings.

Out of 13.55 million wallet addresses associated with Pump.fun, only around 55,296 wallets have reported profits above $10,000, according to Dune Analytics. The data also shows that larger profit margins are rare, with just 0.048% of traders realizing over $100,000 and an even smaller 0.00217% (293 wallets) exceeding $1 million in profits.

The numbers reflect realized profits, calculated when traders close their positions by selling their holdings. Analyst Adam Tehc highlighted the exclusivity of significant gains, stating on Jan. 10, “Only 0.412% of wallets have realized profits of $10,000 or more on Pump.fun’s tokens.”

Pseudonymous analyst Alon pointed out limitations in the data, suggesting it might underrepresent profitable traders. For example, profits from tokens purchased after bonding to decentralized exchange Raydium are not included. Alon speculated that the actual number of highly profitable wallets might be significantly higher, adding that unrealized profits—assets not yet sold—are not accounted for in the analysis. “Early investors with strong conviction in their holdings often have substantial unrealized gains,” Alon noted.

While individual profitability varies, Pump.fun has generated substantial revenue. By early January, the platform’s total earnings reached nearly $398 million, equivalent to 2,016,391 SOL tokens, as reported by Blockchain analytics firm Lookonchain. This milestone was achieved despite a decline in the broader market capitalization of memecoins in recent months.

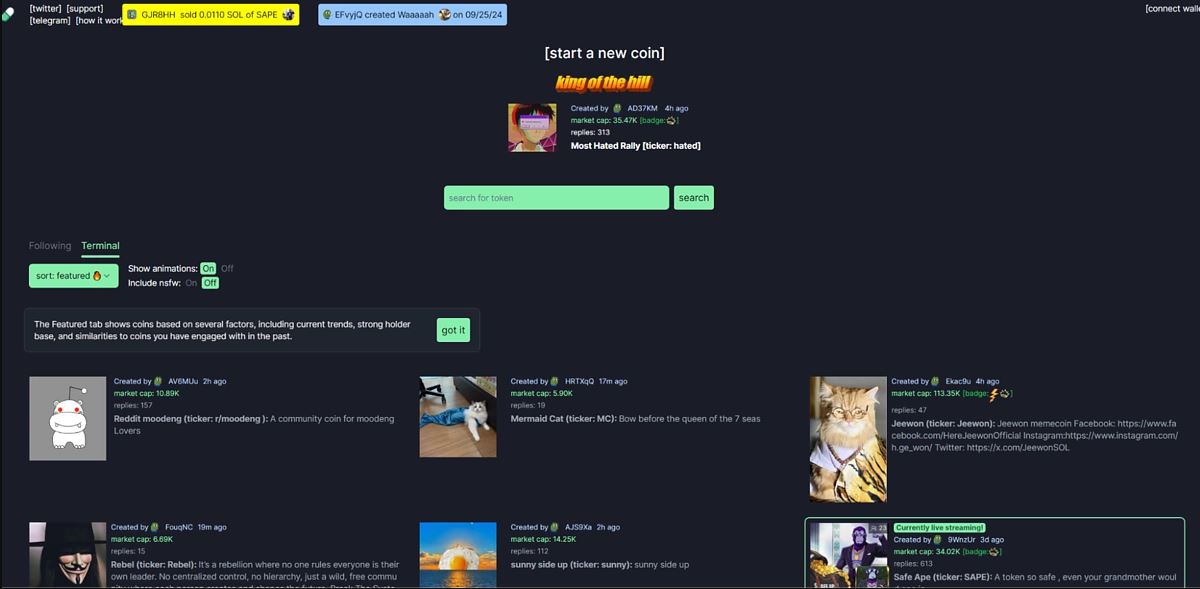

The platform’s liquidity strategy involves depositing over $300 million worth of SOL tokens to Kraken and converting approximately $41 million into USD Coin (USDC). After initial liquidity is secured, memecoins created on Pump.fun are primarily traded on the Raydium exchange.

Pump.fun’s ability to generate significant revenue underscores its position in the volatile memecoin sector, even as questions about trader profitability and the scope of analytics persist. The platform continues to draw attention from traders and investors navigating the speculative world of decentralized finance.

Comment 0