Weiss Ratings has called out four cryptocurrencies which investors should stay away from.

In an online post dated October 24, Weiss Cryptocurrency Ratings said that while a number of blockchain projects are new and innovative, such as Ethereum, NEO, EOS, and Cardano, there are several others that are just “little more than copycat regurgitations of prior projects.”

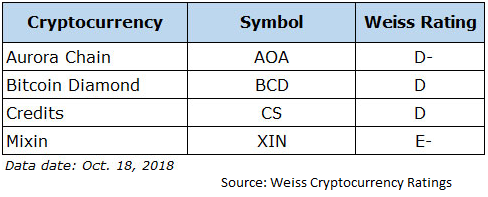

In its recent analysis, the rating agency has named four cryptocurrencies that are “weak” and has assigned them a grade of “D” or lower. These include Aurora Chain (AOA), Bitcoin Diamond (BCD), Credits (CS), and Mixin (XIN).

4 crappy cryptos you shouldn’t touch with a ten-foot pole: Aurora Chain (#AOA, rated D-), #Bitcoin Diamond (#BCD, rated D), #Credits (#CS, rated D) and #Mixin (#XIN, rated E-). For the reasons why, check out Juan’s latest post at: https://t.co/HbAXk1yLbp pic.twitter.com/2za0v5uDmR

— Weiss Ratings (@WeissRatings) October 24, 2018

“Please be aware that these represent strictly a sampling of the 48 cryptocurrencies meriting our Weiss Ratings of “D+” or lower,” it said.

Explaining its reasons for Aurora Chain’s D- rating, the report pointed to a number of red flags including lack of identifiable programmers and developers, sparse adoption metrics, very weak trading volume, no visible computer code, and others.

For Bitcoin Diamond, the agency said that the developers made no significant improvements in the code, adding that it has only a tiny community of users with a virtually nonexistent developer support.

Regarding Credits, Weiss Ratings said that it could find “a credible explanation of precisely how the platform will achieve its lofty speed goals” of a million transactions per second. It went on to state that Credits, which raised $20 million in its initial coin offering (ICO) is “shady at best.”

For Mixin, the report noted that there is a suspicion that its developers’ LinkedIn profiles may be faked. In addition, there are no technical details in whitepaper, the dApp that’s supposed to connect with the Mixin network doesn’t work, and GitHub contains no reference to any of the code that the Mixin whitepaper describes.

Comment 0