The New York State Department of Financial Services (DFS) has granted licenses to two subsidiaries of Chicago-based cryptocurrency exchange Seed CX, as per an announcement made by Financial Services Superintendent Linda A. Lacewell.

According to the press release, Seed Digital Commodities Market LLC (SCXM) and Zero Hash LLC were both awarded with virtual currency licenses. On the other hand, Zero Hash has obtained a money transmitter license.

“The Department’s approval of these new licenses will provide institutional customers with more choice while also protecting consumers and the public through strong anti-money laundering, cybersecurity, and other compliance standards in a continuously evolving global financial services marketplace,” Superintendent Lacewell said, noting that the office has approved more than 20 virtual currency businesses already.

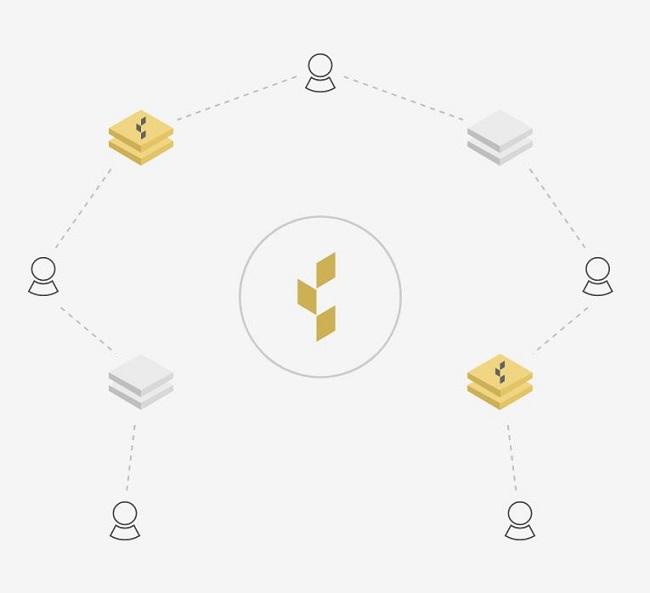

SCXM can now provide services to big financial institutions and trading firms as a matching engine for cryptocurrency buyers and sellers and serve as a platform for cryptocurrency block trades. On the other hand, Zero Hash will take care of transaction settlements.

“As virtual currency license holders we will be able to expand trading and settlement services to New York firms through our institutional platform that offers the strong institutional technology, the operational support, and the regulatory compliance that institutions demand,” Edward Woodford, Seed CX Co-Founder and CEO, said.

Earlier this year, Seed CX, which is backed by big firms like is backed by Bain Capital, OKCoin USA, Dekrypt Capital, released a new digital asset wallet solution with an on-chain settlement feature to cater to institutional clients.

Comment 21