The U.S. Securities and Exchange Commission (SEC) has granted ethereum-based token Props a Regulation A+ qualification, making it the first consumer-facing SEC-qualified crypto token.

As per its press release, Props can now start rewarding tokens to contributing apps, users, and validators, including the 47 million registered users of YouNow, the first app on the Props Network.

The video-streaming platform said it will start distributing a total of 187 million Props tokens to reward content creators for in-app activities that “drive community engagement” and compensate users for engaging with the platform, according to its SEC filing.

“Online video content made by independent creators has become massively popular, but still lacks diverse ways for creators to turn their content to a meaningful source of ongoing income,” YouTuber and Props Investor Casey Neistat said.

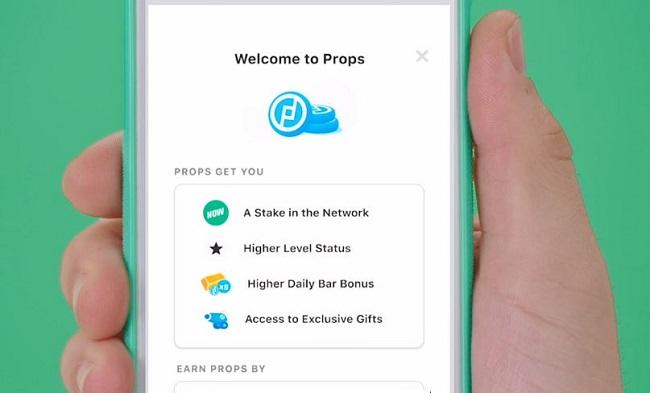

YouNow will also entice users to earn Props by offering VIP status and increasing their purchasing power in an in-app currency called "Bars." Props holders will enjoy exclusive perks and discounts.

Beyond the YouNow use case, Props team plans to create open-source tools that will allow additional apps to joins the Props network to reward users. It is expecting to welcome three more apps to come online this year, including PeerStream’s consumer apps Paltalk and Camfrog, and SplitmediaLabs’s XSplit.

“Our offering of Props is the first consumer-facing offering of ‘Howey tokens’ to be qualified by the SEC. It makes it the first offering of consumer-oriented utility tokens that the SEC deems compliant, outside of Bitcoin and Ether,” Adi Sideman, Props CEO, told TechCrunch.

“We used Regulation A+ for this qualification, so that Props may be earned by, and provide functionality to, non-accredited investors, users, apps and validators in compliance with U.S. regulations,” he added.

Regulation A+ is an alternative to traditional initial public offering (IPO) designed to cater to startups that need early funding. According to the filing, each token will cost $0.1369 at launch. However, as the platform expands and token demand increases, token holders may also enjoy a profit.

Props tokens may also be transferred to various applications and wallets, but they cannot be swapped for fiat currencies. The company is also working to have Props listed on Alternative Trading System that work like cryptocurrency exchanges.

According to TechCrunch, Props has worked closely with the SEC for 2 years before getting approval. The SEC wanted to make sure that the company will not mislead investors and raise capital illegally.

The report follows after the SEC also okayed blockchain startup Blockstack to conduct a $28 million digital token offering under Regulation A+. However, unlike Props that lets users earn or “mine” tokens by engaging with apps, Blockstack’s investors will receive tokens.

Comment 5