Major cryptocurrencies – Bitcoin, Ethereum, Ripple, and others – suffered a major price crash today, September 5th.

Bitcoin price is down by over 6 percent so far in the day, Ethereum by over 12 percent, and Ripple by 11 percent.

FxStreet pointed out that crash comes amid rumors of “Bitcoin whales” seeking to dump large amounts of BTC in the market. As to who these whales are, the report states:

“The news in the market is that a Bitcoin whale, possibly Silk Road; a darknet website that was shut down by the FBI or Mt.Gox, the cryptocurrency exchange that closed doors in 2011 after being victim to a hack attack.”

As #Bitcoin $1B Whale Wallet Goes Active, Should Investors Worry? - https://t.co/x5bDqgTZK3 pic.twitter.com/ngh5XkGBrP

— Tanzeel Akhtar (@Tanzeel_Akhtar) September 5, 2018

Cryptovest reported this week that around $1 billion worth of bitcoin was recently moved around in Silk Road wallet addresses. According to the report, the manner in which the splitting and movement of bitcoins have been carried out seemed quite strategic, as it says:

“…this isn’t the work of someone who is inexperienced with moving large amounts of money around without arousing suspicion. What’s more, it doesn’t appear that the wallet is accounted for by the FBI. Although the organization managed to confiscate a sizeable wallet from Silk Road, it wasn’t the only address the dark web marketplace possessed.”

In yet another report on FxStreet, Tanya Abrosimova writes that the recent announcement from ShapeShift on introducing membership on its platform, “might have added fuel to the fire.”

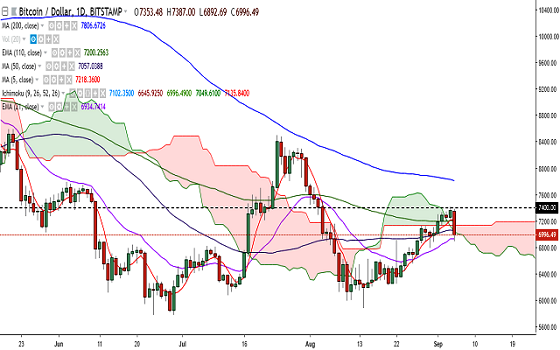

BTC/USD fell to 6892 levels as it broke below cloud. It has found support near 100-DMA and is currently trading at 6971 levels at the time of writing. A break below 100-DMA could see the pair testing 6814 (20-DMA)/6707 (4h 200-SMA).

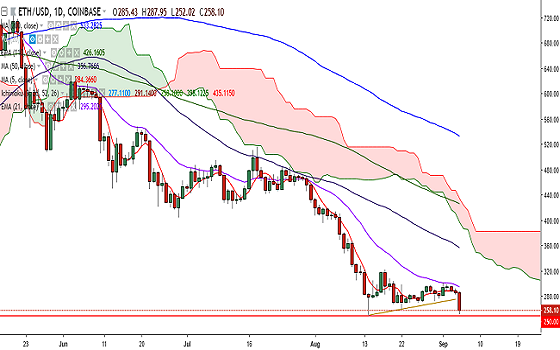

ETH/USD is trading to 2018 low of 250 levels hit on August 14. Further weakness would drag the pair to 230 (127.2% retracement of 250.28 and 322.16)/200.

XRP/USD is currently hovering around 0.3009 levels after it dropped to 0.2965 levels. Support is seen at 2942 (61.8% retracement of 0.2450 and 0.3739) and a break below would target 0.2879 (August 11 low)/0.2700.

Comment 0