A former product manager at OpenSea, Nate Chastain, has been charged with insider trading of non-fungible tokens (NFTs) and is currently on trial. Chastain allegedly used his position to purchase NFTs that would be featured on the platform's homepage in advance and then sold them at a higher price, making a profit of approximately $50,000.

Chastain's defense argued to the jury that he was never informed that the NFT information he had access to was confidential. One of Chastain's attorneys, Daniel Filor, acknowledged that his client had made these trades but argued that Chastain did not realize that such trades could be considered illegal since OpenSea did not consider them sensitive business information at the time.

The prosecution argued that Chastain's use of anonymous accounts to conduct the trades indicates he knew he was doing something illegal. Prosecutor Thomas Burnett told the jury that Chastain was using OpenSea's information "like his own piggy bank. It was as good as free money."

Chastain's trial is the first insider trading case involving digital assets and is expected to set a legal precedent for the cryptocurrency industry. If convicted, Chastain faces up to 20 years in prison on the wire fraud charge and up to 10 years on the money laundering charge.

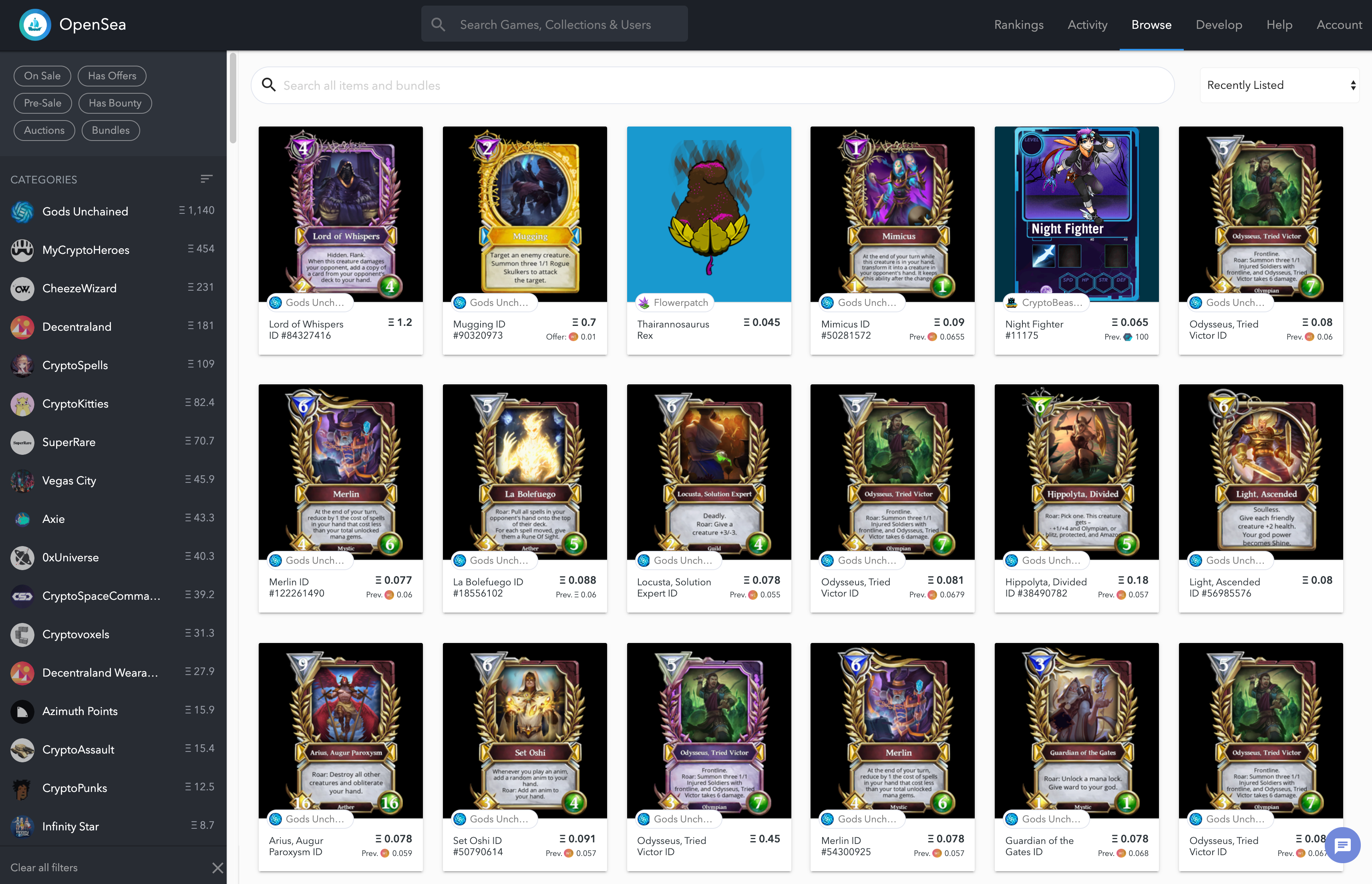

OpenSea, the world's largest NFT marketplace, has not been charged in the case, but the company has faced scrutiny over its handling of insider trading allegations involving its employees. In September 2021, OpenSea announced that it had conducted an internal investigation and found that one of its employees had engaged in insider trading. The employee was fired, and OpenSea said it had implemented new policies to prevent similar incidents from happening in the future.

Chastain's trial is expected to last several weeks, and the verdict could have significant implications for the future of the crypto industry. The case has raised concerns about the lack of regulation in the crypto industry and the potential for insider trading and other forms of market manipulation. Some experts have called for increased oversight of digital asset marketplaces to prevent such abuses from occurring.

Comment 0