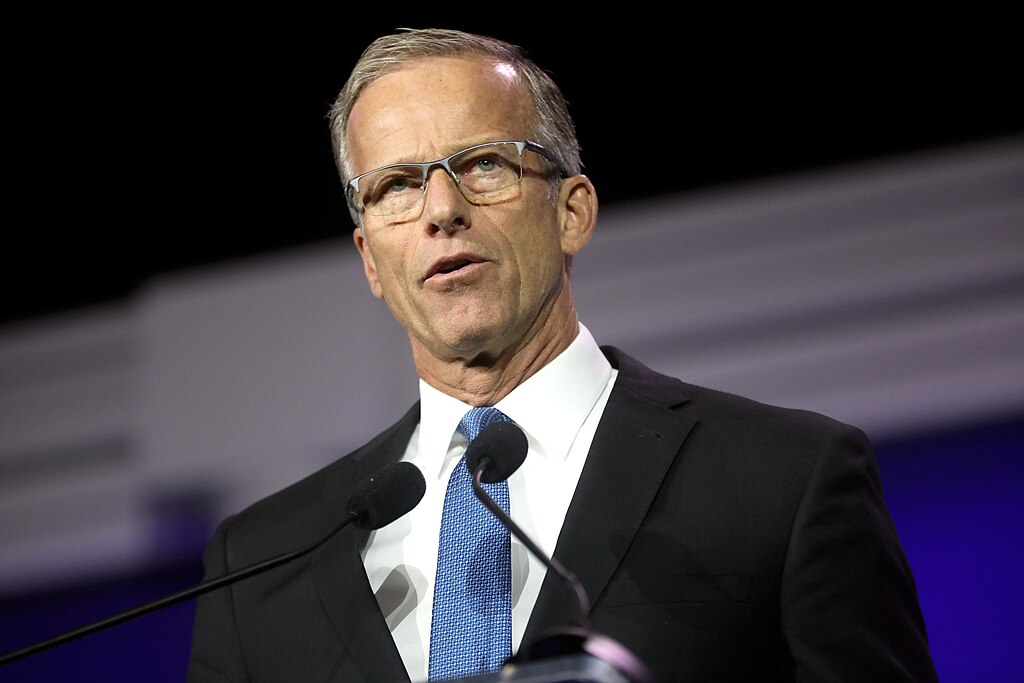

In a recent Minnesota Transportation Conference and Expo, Neel Kashkari, the head of the Minneapolis Federal Reserve Bank, engaged in a candid dialogue where he expressed his skepticism regarding central bank digital currencies (CBDCs).

Kashkari, helming the Minneapolis Federal Reserve Bank, shared his insights on various subjects at the engaging event on May 15. While most of his talk was not centered around blockchain or cryptocurrency, he took the time to give an unvarnished view of CBDCs during a Q&A session following his main discourse.

Delving into the matter of CBDCs, Kashkari admitted, "We're studying it." However, he opined that the Federal Reserve would need congressional approval to roll out its own digital currency. According to him, the chatter surrounding the potential of CBDCs is nothing more than an elaborate "handwaving word salad," implying its superiority. Kashkari also indicated that there hasn't been substantial proof of CBDCs being superior and raised concerns about the potential for government surveillance of individual transactions, citing China's motivation to roll out its own CBDC.

Kashkari went further to highlight additional potential downsides of CBDCs. One concern he pointed out was the potential for the government to apply negative interest to an individual's account. He mentioned that platforms like Venmo prohibit such practices, and the Federal Reserve shares a similar stance against these policies. Additionally, he emphasized that CBDCs might facilitate direct account taxation, signaling another possible disadvantage.

A Central Bank Digital Currency (CBDC) represents a digital form of a country's fiat currency, issued and regulated by the central bank, facilitating secure, efficient, and traceable financial transactions. Kashkari's remarks underscore the need for a thoughtful and cautious approach in the nascent world of CBDCs.

Comment 0