Seven cryptocurrency and decentralized finance (DeFi) platforms are preparing to unlock tokens this week, which could lead to short-term volatility and selling pressure on token prices.

The first major protocol to unlock tokens this week is the 1inch exchange, with just 21,429 tokens being released. The 1INCH token unlock is worth less than $10,000 at current prices of around $0.463. Token Unlocks revealed that 37% of the total supply of around 1.4 billion tokens remains locked.

On May 1, the Polkadot-based web3 finance platform Acala will also release assets, with around 27.4 million ACA tokens valued at roughly $2.3 million to be unlocked, representing 2.74% of the total supply.

Acala tokenomics are more evenly spread, with 34% allocated to crowd loan participants, 29% for strategic partners, and 12% for the reserve. The vesting and unlock schedule runs until March 2028. ACA is currently trading down 97% from its peak at $0.087.

Nym will unlock almost 7.4% of its total supply on May 3, with around $16.3 million worth of NYM tokens to be released, likely putting downward pressure on prices this week.

On the same day, the Trader Joe DEX will release 108,000 JOE tokens. May 5 will see token unlocks for Liquity (LQTY) and Galxe (GAL), while on May 7, Tornado Cash will unlock 175,000 TORN tokens worth around $1.3 million.

While the process of token unlocking is intended to align incentives for all DeFi project investors and stakeholders, it can often cause short-term volatility and selling pressure.

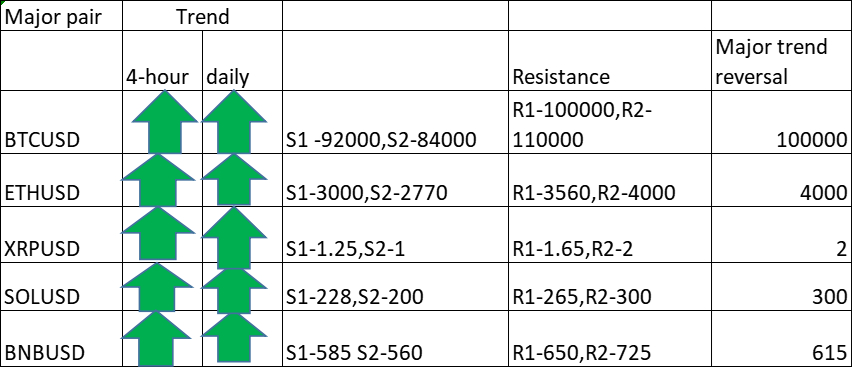

As a result, crypto markets have turned red during the Monday morning Asian trading session, with total capitalization shrinking by 1.7% on the day, falling to $1.23 trillion. BTC is down 2% at $28,595, while Ethereum (ETH) has lost 2.7% in a slide to $1,848. The only crypto asset in the top 20 that has notched up a gain is Binance's BNB, which has gained 4.4% to reach $335 at the time of writing.

The unlocking of tokens by DeFi platforms is a common practice that allows token holders to access their holdings and can bring new liquidity to the market. However, it can also lead to a temporary drop in prices as the increased supply dilutes the value of existing tokens.

Investors are advised to exercise caution and carefully consider the potential impact of token unlocks before making any investment decisions. It is also important to keep track of each DeFi project's tokenomics and release schedules to stay informed of upcoming token unlocks.

Despite the short-term volatility, the long-term potential of DeFi platforms remains promising, as they offer new opportunities for decentralized financial services and investment options. As the crypto market continues to evolve, it is expected that more DeFi platforms will emerge, and investors will need to stay informed and adapt to changes in the market.

Overall, the unlocking of tokens by DeFi platforms this week is likely to bring increased volatility to the crypto market, and investors should proceed with caution while keeping an eye on the long-term potential of these platforms.

Comment 0