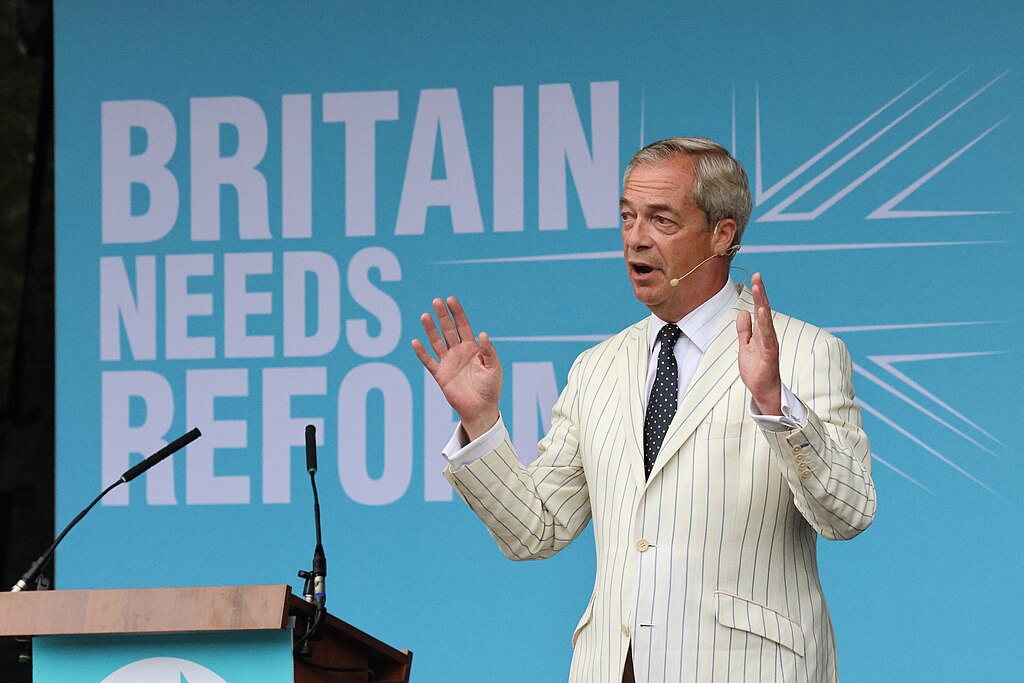

Nigel Farage has announced a bold crypto-focused economic plan, signaling a major political and financial shift in the United Kingdom. Drawing inspiration from Donald Trump’s 2024 campaign strategy, the Reform UK leader aims to position London as a global hub for digital assets and challenge Prime Minister Keir Starmer’s Labor government.

Speaking in London, Farage introduced his Cryptoassets and Digital Finance Bill, outlining a plan to create a national Bitcoin reserve worth $6.4 billion (£5 billion), funded by assets seized from criminals. The bill also proposes a 10% flat tax on crypto gains and legal protection against bank account closures for lawful crypto users.

Farage criticized the Bank of England’s cautious approach toward cryptocurrencies, calling its limits on stablecoin holdings “ridiculous” and vowing to block any central bank digital currency (CBDC) rollout, labeling it “the ultimate authoritarian nightmare.” His remarks reflect growing public frustration with overregulation and stagnation in Britain’s financial services sector.

The crypto community has welcomed Farage’s pro-innovation stance, with social media abuzz over the proposal’s potential to reshape national monetary policy. Some analysts suggest that, with Reform UK leading in polls, Bitcoin could one day become part of the UK’s official financial reserves.

Recent projections by Politico show Reform UK with 31% voter support—translating to 311 parliamentary seats, just shy of a majority. This signals a collapse of traditional two-party dominance and rising support for policies promoting lower taxes and deregulation.

Farage argues that his proposed 10% crypto tax and simplified rules would restore competitiveness and attract blockchain and fintech companies back to the UK. As global competition for digital-asset leadership intensifies, his initiative could redefine Britain’s economic trajectory and financial identity.

Comment 0