Blockchain startup Waves has shut down its decentralized exchange (DEX) which went live in April 2017, Cointelegraph reported.

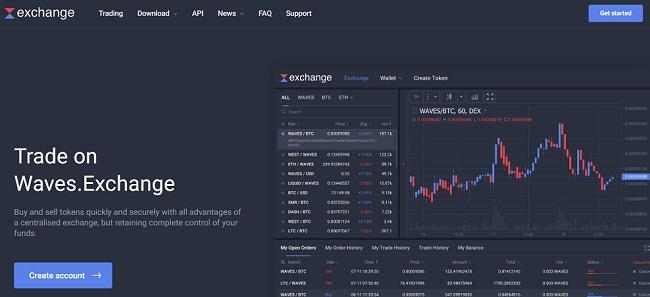

As per the report, Waves DEX has been shut down to resume operations as Waves.Exchange – a hybrid exchange. The firm has already begun the process of moving the activities from the old domain to Waves.Exchange.

https://t.co/z9r4K8yi2X has been launched! All the exchange services are now fully operational. Your feedback and suggestions are welcome. Enjoy! pic.twitter.com/amY2p9mHHL

— Waves.Exchange (@Waves_Exchange) December 2, 2019

“From this point onwards, the old version of the exchange will be unavailable, and the website will offer only functionality to support migration. User funds held on Waves DEX will remain completely safe during and after the process,” Waves said.

The new platform reportedly offers the best of both centralized and decentralized exchanges. Waves said that Waves.Exchange combines the features of centralized trading platforms with the irreversibility of transactions, safety and user control of funds of DEXs.

The development and support of the new platform will be managed by a separate team, which will also include former Waves core team members, the report said. Also, Waves’ core team will now focus on the development of the protocol, its open and private implementation, sharding and infrastructure.

“Waves DEX was a kind of prototype. Now, after 2 years of operation, it has grown and become a separate project. [...] Now it’s time for us to focus on protocol development and hand over the exchange to an external team and community separate from Waves, so we can merge all the infrastructure teams into one, synchronizing development work and taking the combined product to a new level,” Waves founder and CEO Sasha Ivanov said.

Going forward, Waves plans to launch partner and market maker programs as well as “new tools for users to generate passive income, including the opportunity to stake stablecoins and collect interest with very low risk.” The company said that it will enable Tether (USDT) trading once the gateway goes live later this month.

Just recently, another decentralized exchange CryptoBridge announced its plan to terminate its operations on Dec. 15, citing “increasing regulation, inability to fund further development and maintain operations” as the reasons behind its decision.

Comment 29