Siam Commercial Bank is partnering with Lightnet to introduce 24/7 stablecoin remittance services, drastically cutting fees for global payments. This move positions SCB at the forefront of innovation in cross-border transactions, promising faster and more cost-effective transfers for customers.

SCB Partners with Lightnet to Offer 24/7 Stablecoin Remittances

The longest-running commercial bank in Thailand, Siam Commercial Bank (SCB), has just announced a partnership with fintech firm Lightnet to provide customers with stablecoin international payment and remittance services.

According to Cointelegraph, by integrating with stablecoin services, customers will have access to low-cost, round-the-clock cross-border transaction sending and receiving.

Lower Transaction Fees for Cross-Border Payments

For those receiving remittances from currencies with higher value, stablecoins are a good option due to their lower transaction fees. All of Lightnet's clients will reap the benefits of the tokenized fiat equivalents, according to CEO Tridbodi Arunanondchai.

“This project also promotes financial inclusion as there is a lower capital requirement per transaction. Beyond this, the project also provides unique value propositions to retail, corporate, and institutional clients.”

Regulatory Sandbox Pilot in Thailand

The new stablecoin services were piloted by the bank in the Bank of Thailand's regulatory sandbox, an initiative that allows banks to test out digital assets with less stringent rules and regulations, free from the threat of legal action.

Stablecoin Adoption Driven by Currency Devaluation

Stablecoins denominated in US dollars are becoming more popular among those living in poor nations who are trying to protect their purchasing power against the fast depreciation of their local currencies.

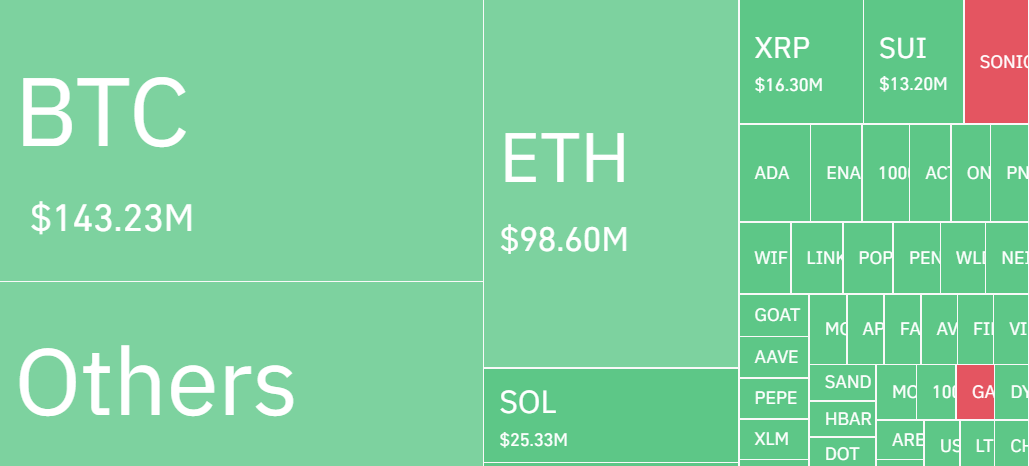

Stablecoins currently make up over 43% of all crypto transactions in Sub-Saharan Africa, according to a new research from Chainalysis. There is a substantial association between currency devaluation and stablecoin adoption, according to Eric Jardine, cybercrimes research lead at Chainalysis, who also spoke with Cointelegraph.

Latin America’s Growing Reliance on Stablecoins

The results from Chainalysis appear to be supported by data from Latin America. In 2023, crypto payments made up 9% of remittances in Venezuela, a country experiencing severe currency devaluation.

Over half of the digital assets sent to Venezuela as remittances that year were stablecoins, according to Chainalysis. Mexico, Argentina, Colombia, and Brazil all exhibit this pattern as well.

South America’s Remittance Growth Outpaces Other Regions

Remittances to South America were found to be expanding at a higher rate than any other region in the world, according to a report issued in March 2024 by payments giant Mastercard.

Blockchain assets, such as stablecoins, will keep driving the transition to a digital economy, according to the credit card and payments business.

Comment 0