The crypto market rally, which pushed Bitcoin past $60,000 recently, has attracted countless new investors into the asset class. However, an investment expert warns that trouble could be looming on the horizon as governments could impose “shocking” taxes as well as “prohibitions against capital movements” into assets such as BTC.

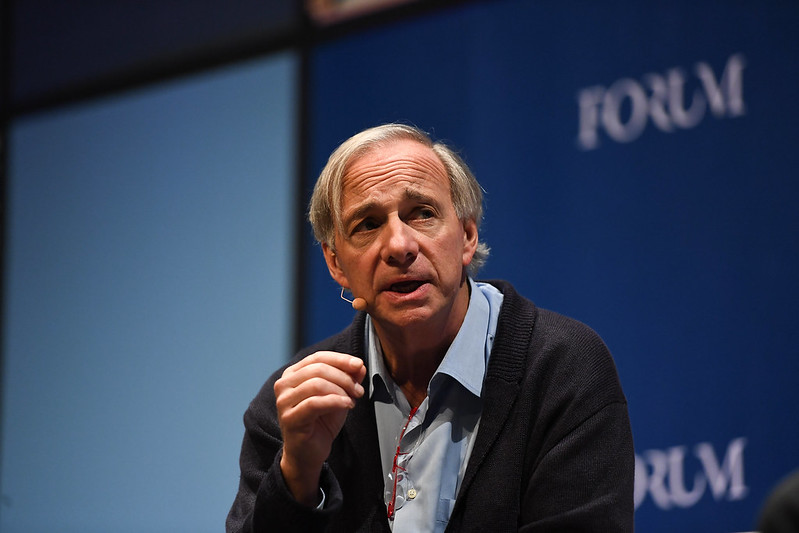

Bridgewater Associates founder and chief investment officer Ray Dalio recently posted an article on Linkedin titled “Why in the World Would You Own Bonds When…” In the piece, the investment expert shared his thoughts on the investment landscape and touched on a variety of topics including Bitcoin, bonds, and taxation.

Dalio pointed out that bonds offer ridiculously low yields at the moment. “Real yields of reserve currency sovereign bonds are negative and the lowest ever,” the Bridgewater CEO wrote. “These extremely low or nonexistent yields do not meet these asset holders’ funding needs. For example, pension funds, insurance companies, sovereign wealth funds, and savings accounts cannot meet their financial needs with these investments so holding bonds assure their failure to meet their obligations..”

Given this low-interest scenario, the asset class is no longer practical for investors. “The economics of investing in bonds (and most financial assets) has become stupid,” Dalio added. “The purpose of investing is to have money in a storehold of wealth that you can convert into buying power at a later date.”

“There are now over $75 trillion of US debt assets of varying maturities,” Dalio pointed out. Given the low-interest rate of these instruments, it’s highly possible that some of their holders to sell them to get cash.

However, due to the large amount involved, the government will likely print more money causing fiat to devalue. “The problem is that, at current valuations, there is way too much money in these financial assets for it to be a realistic expectation that any significant percentage of that bond money can be turned into cash and exchanged for goods and services,” the investors said. He explained that this actually happened in the 1930-45 period and the 1970-80 period.

This could affect Bitcoin investors as well. “If history and logic are to be a guide, policymakers who are short of money will raise taxes and won’t like these capital movements out of debt assets and into other storehold of wealth assets and other tax domains so they could very well impose prohibitions against capital movements to other assets (e.g., gold, Bitcoin, etc.) and other locations. These tax changes could be more shocking than expected,” Dalio added.

Comment 0