The realm of Bitcoin (BTC) is not unfamiliar with volatility and speculation. Recent events, on the other hand, indicate the possibility of a turning point for Bitcoin following the selloffs committed by the German government. Here are five reasons why the price of Bitcoin might be on the verge of experiencing a vast rally shortly.

1. The Capitulation of Miners

Recent evidence suggests that Bitcoin miners are under incredible strain, and the capitulation of miners frequently indicates that the market has reached its bottom. The proportion of Bitcoin's True Hashrate Drawdown has reached 7.6%, comparable to the levels that were present when Bitcoin was trading at $16,000 following the collapse of FTX.

This degree of capitulation suggests that less powerful miners are being compelled to shut down their operations, a phenomenon that has historically occurred before a recovery in the price of Bitcoin. Because these miners are ceasing operations, the amount of selling pressure they put on the market is starting to lessen. This facilitates the potential for a price recovery.

2. Exit of the Bitcoin Selloff in Germany

Recently, the German government ended its massive Bitcoin selloff, which began on June 19 and continued until the present day. Over the course of three weeks, the market absorbed over $3.5 billion worth of Bitcoin liquidations. Bitcoin's price has remained stable at approximately $58,000 despite the tremendous amount of sell pressure. This consistency amid enormous selloffs is a powerful indicator of the strength beneath the market's surface.

On the social media site X, Michaël van de Poppe, a prominent crypto expert, brought attention to the endurance of the cryptocurrency. In his remarks, he stressed that the markets had successfully absorbed this enormous downward pressure. Although it is not anticipated that the German government will engage in any future sell-offs, the absence of this significant negative pressure may make it possible for the price of Bitcoin to climb upwards. The trend has already begun, as seen by the cost of Bitcoin climbing above $60,000.

3. The Accumulation of All Bitcoin Whales

In the cryptocurrency markets, whale behavior frequently plays a significant role, and recent data indicates that a bullish trend is developing. According to data provided by IntoTheBlock, a blockchain analytics firm, Bitcoin whales have amassed an additional 71,000 BTC over the past week. This group of whales capitalized on the decline brought about by the German selloff.

Because of this significant accumulation, the total volume of whale transactions on the Bitcoin network has reached an astonishing $41.32 billion. The weekly spike in whale transactions has continued to be robust despite the fact that the 24-hour pace of change has decreased by 8%. Because of the continued accumulation of these huge holders, the quantity of Bitcoin is being depleted, which frequently results in a price increase.

4. Investments from Around the World Into Bitcoin Exchange-Traded Funds

Exchange-traded funds (ETFs) that invest in Bitcoin have witnessed extraordinary capital inflows worldwide. Since the end of June, exchange-traded funds (ETFs) in Hong Kong have seen a 28.6% increase in their reserves, bringing the total amount of such funds to 4,941 BTC as of July 13. Since its inception, the Monochrome Bitcoin Exchange-Traded Fund (IBTC) has garnered much attention in Australia and is getting close to reaching the 100 BTC threshold.

In the meantime, the United States has seen its Bitcoin exchange-traded funds (ETFs) see net inflows that have exceeded $1.1 billion in only one week. This represents the highest weekly inflow that has ever been noted. The spike in investments in exchange-traded funds (ETFs) shows the growing hunger for Bitcoin among institutions. It may cause the price of Bitcoin to increase as more capital enters the market.

5. A High Probability That The Federal Reserve Will Reduce Interest Rates

The United States Federal Reserve is sending signals and economic indicators that point to a high likelihood of a reduction in interest rates, which could substantially impact the price of bitcoin. Mike McGlone, an analyst at Bloomberg, has forecast that the Federal Reserve will reduce interest rates in response to a reversal in economic conditions in the United States.

Based on historical analogies, the first-rate reduction took place in September 2007, following the significant rate increases between 2004 and 2006. In a similar vein, a reduction in interest rates is projected to take place in September, following the previous rate hikes, which totaled 525 basis points compared to the first quarter of 2022.

The CME FedWatch tool indicates a 90.3% probability of a rate cut occurring in September. However, June's Producer Price Index (PPI) data was relatively high, indicating that inflation is continuing. The United States dollar tends to weaken when interest rates are lowered, leading to a rise in investor interest in alternative assets such as bitcoin. Because of this, the price of Bitcoin can experience a vast increase.

URL copied.

URL copied.

Font size

A

A

A

A

5 Key Factors Signaling a Potential Bitcoin Price Rally Soon

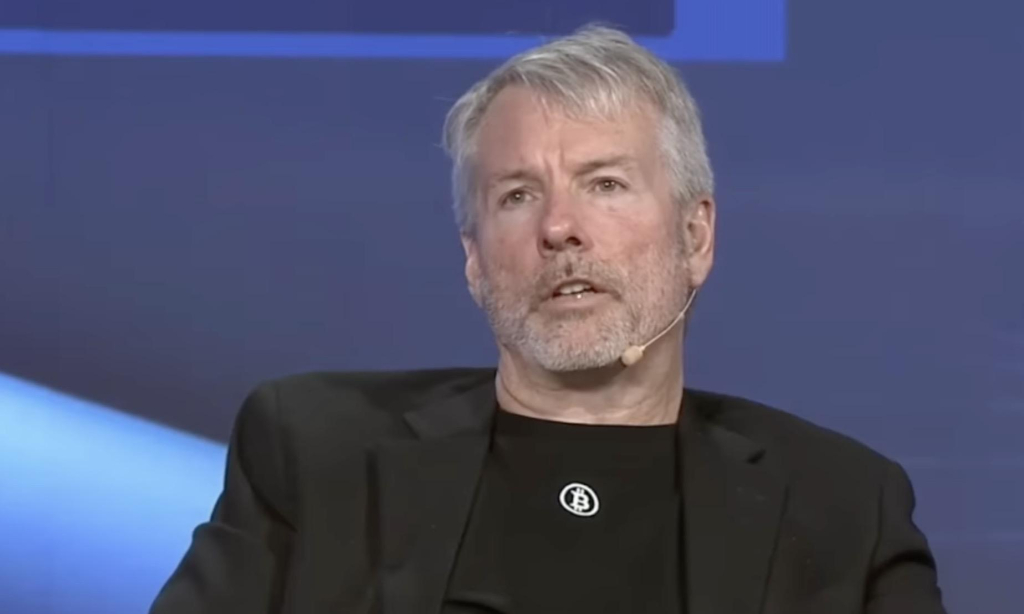

Key indicators suggest a potential rally in Bitcoin's price as market conditions improve. Photo: EconoTimes

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>

Comment 0