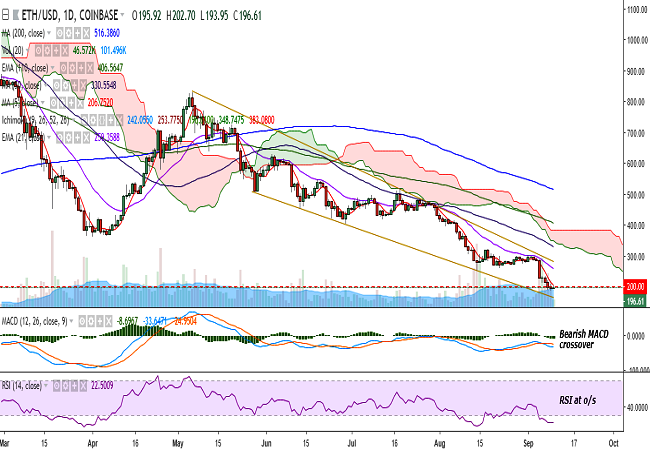

(Refer ETH/USD chart on Trading View)

ETH/USD broke below the 200-mark and hit a fresh low of 185 on September 9.

The pair is trading at 195 levels at the time of writing, forming a gravestone doji pattern on the daily chart (Coinbase).

The pair’s upside is being capped by 206 (5-DMA) and a break above would target 242 (10-DMA)/259 (21-EMA). Further strength would target 283 (4h 200-SMA)/300.

On the flip side, support is seen at 178 (127.2% extension of 515.88 and 250.28) and any violation would drag it to 161 (channel bottom)/130 (15 July 2017 low).

Technical indicators are bearish on daily, weekly and intraday charts with no major sign of reversal.

Markets are now speculating the reasons that have caused this sell-off. Ethereum World News pointed out that there are two primary theories – the introduction of new BitMEX ETH perpetual swap contract and ICO sell-off factor.

$ETH now -57% since launching on Bitmex in just over 1 month. pic.twitter.com/jfW4TCYcEE

— ₿-Eazy ???? (@cryptoeazy) September 9, 2018

BitMEX ETH perpetual swap contract enables traders to short the price of ETH with up to 100x leverage. Crypto enthusiasts are now speculating that the contract allowed “pessimistic traders to weigh down on the price of ETH.”

Another probable reason is the ICO sell-off factor, according to which projects have started liquidating their ETH holdings into fiat, further driving the prices down. Data from Santiment reveals that projects have spent more than 100,000 ETH in the past week itself.