Diamond Standard is a new company that has officially debuted as the manufacturer of the world’s first fungible diamond commodity product.

As each diamond is different, they cannot be standardized for trading purposes like gold, which can be traded in standardized bars.

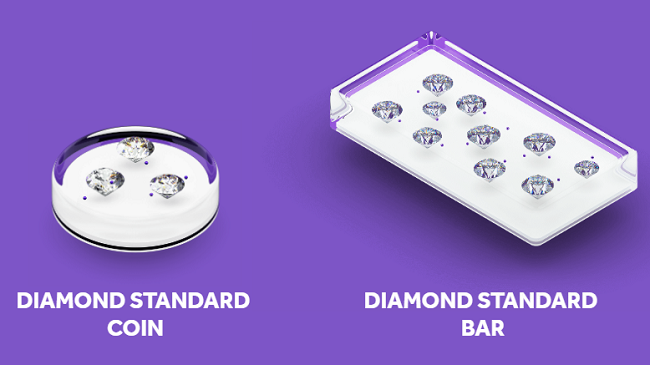

The U.S. and Bermuda-based company is addressing this challenge with Diamond Standard Coin and Diamond Standard Bar. These are fungible sets of diamonds, Diamond Standard explained, with each set containing an identical scarcity of certified diamonds.

"Diamonds are a valuable natural resource, but unusable by institutional investors. Unlike gold and platinum, each diamond is different, so price is negotiable," explains Cormac Kinney, founder and CEO of Diamond Standard Co.

"We created a diamond commodity by grouping sets of diamonds in a fair and transparent way. The sets are fungible, and the diamonds are independently certified, and the key is that they are sourced through a regulated exchange, with market-driven price discovery."

According to the official release, the fungible sets of diamonds are sealed in transparent resin containing a military grade wireless encryption chip, which stores Bitcarbon – a blockchain token which can be instantly authenticated and remotely audited.

The Bitcarbon is used for secure, instant transactions, and is compatible with every blockchain platform. When a customer deposits their Diamond Standard Coin with a custodian, they store it in a smart cabinet. But the digital key to the Bitcarbon token remains with the customer.

A customer can sell their Bitcarbon anytime – when they sell the token, they sell the Diamond Standard Coin, meaning that the coin and the token are inseparable.

“For every transaction, the encryption chip is challenged by the blockchain in a process called "proof-of-asset." When the commodity is held by the owner it can be authenticated and sold using a smartphone, anywhere in the world,” the company explained.

Diamond Standard further said the Diamond Standard Coin is intended to have a daily market price and trade on global exchanges by transacting the Bitcarbon token on the blockchain. The token also can be used as collateral to borrow money or asset-back smart contracts—with a blockchain-recorded lien.

CoinDesk reported that Bitcarbon’s base protocol is EOS and the company will base Bitcarbon on ethereum as an ERC-20 token at launch.

Kinney told CoinDesk that the company has raised more than $10 million in funding from multiple investors, including Jamie Dinan, founder of York Capital Management, and Glen Kacher, founder of Light Street Capital. It is seeking regulatory approval from the Bermuda Monetary Authority.